Porinju Veliyath 9th January 2023

India remains a stock-pickers' paradise

We will continue to grow despite global inflation. Stay Invested for the long term.

EQ team wishes you and all your loved ones a happy and prosperous New Year. Hope CY2023 brings better investment opportunities and help us create wealth for our investors.

As all our investors know; we are bottom-up stock pickers guided by value investing principles. For us macro factors are not that critical in identifying investable opportunities. Meaning, we don't project next year’s GDP growth or inflation numbers etc. to decide what to buy or sell. But we are aware about the long-term trends and consequences of macros, and we learn the right lessons from them.

Learning the right lessons from past …

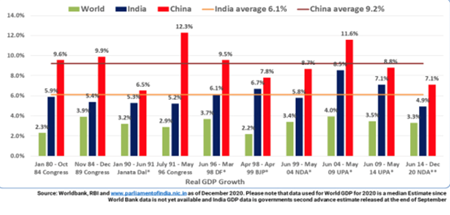

Indian economy has broadly been growing at 6% CAGR for last several decades.

(Exhibit 1) – India GDP has averaged 6% CAGR for 40 years

A growing economy enables companies to grow their revenues and profits. And as profits grow stock prices grow with them eventually. This very broad logic stands strong especially in young economy like India.

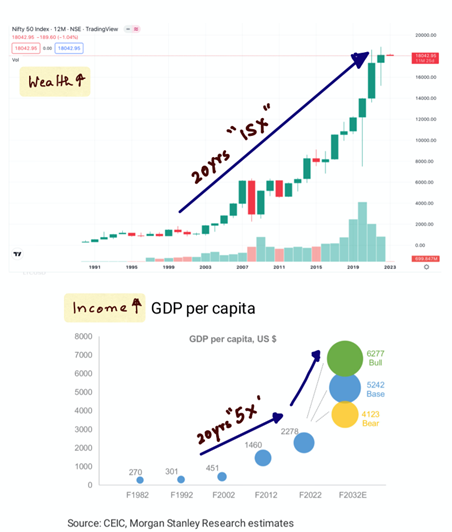

Per capita GDP in $ terms roughly became 5X during the 20 years period of 2002 to 2022. During the same period Nifty has become 15X. This is the real power of owning equities. Chart below is instructive in several ways - Refer Exhibit 2. (We are mainly concerned about the trend and not on delta so much. Both are very different series of statistics, so no need to read too much of them.)

- First, the disproportionate wealth effect in equities over long term compared to GDP growth in income terms.

- Second, ignoring the short to medium term volatility of the markets; Nifty is trending up year after year.

- And third, we have seen variety of political, economic, and social risk coming and going during this period, but compounding has continued.

- Compounding of wealth is all about two things - rate of change and time that you compound. Those who have spent enough time in market have been rewarded in India and we see no reason why this should be otherwise in future.

Exhibit 2: Long trend for Nifty (Equities) & Per Capital GDP

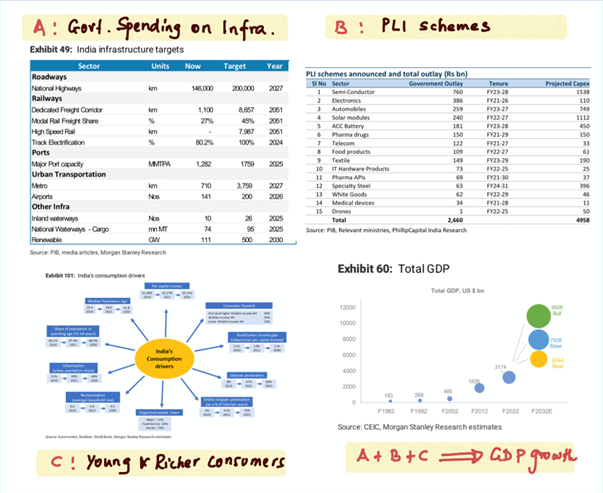

Future growth drivers are sound and structural …

Current consensus estimates from various sources indicate that India is poised to increase its per capita GDP at a much faster rate than in the past. Drivers of the economy are a mix of several structural trends which are now well accepted by most observers. Favourable demographics, cumulative benefits of a host of ongoing reforms, technology disruption - are all advantageous to India.

India is poised to see a very healthy capital spending cycle in the coming decade. Cleaning up of banking system, increasing utilisation rates in several sectors, continuing public spending on infrastructure and PLI initiatives in host of industries are likely to drive private and public spending. Along with capital spending, a young economy with rising income is also a key driver of structural consumption.

Exhibit 3: Driver of Growth = Public & Private Capex + Consumption

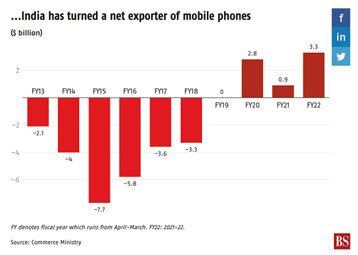

Also, encouraging are the trends in exports from India. PLI schemes along with a shifting geopolitical environment is favourably driving several pockets of export opportunities. As an example, note what is happening in light electronics manufacturing. India from being the largest consumer and importer of mobile handset has now become the net exporter. And the story seems to be just the beginning.

Exhibit 4: Rising outsourcing from India in manufacturing

Risk that is on top of the minds of all - inflation…

Rising Inflation has been making headlines. Cutting all the noise around it one should focus on the first principles of how it affects us - individuals. Say, we paid Rs. 2,000 for a “Hindware” faucet for our kitchen - one of the best brands in the country owned by our investee company “Hindware Home Innovation Ltd”. After 10 years we may need to replace it. Inflation in commodities, wages, rent etc will increase the cost and thereby the selling price of the faucet. Being a leader and an innovator in the business HHIL will not only pass on all the cost increase, but also will mark up on top of that maintaining their margins - which we can call pricing power.

We may end up paying Rs. 4,000 for the faucet after 10 years - implying 7-8% inflation. How do we protect ourselves from this decline in purchasing power? Well, not by getting worried about inflation number every week but by being invested in businesses like HHIL which can absorb the inflation and earn more over it. Business profits are the only true hedge to long-term inflation – we benefit through part ownership in them. However, this transfer of cost increases eventually to corporate profits is not exactly linear but has time lags. The relationship works only when we see the long-term picture. Over time, equities are the only antidote to inflation; no other asset class can help.

Focus on the right game – then play and play long…

We strongly urge investors to look at the above illustrated big pictures as we begin the new year.

With our team’s collective experience of several decades tracking Indian equity markets, we strongly feel that investors who keep faith in equities by remaining invested all the time for long term - ignoring the near-term volatilities and noise are likely to generate substantial wealth.

De-boarding the markets every now and then because coming few quarters are looking challenging or continuously restructuring the portfolio by churning from one stock to another is only an emotional reaction upon facing uncertainties – and the future always seems to be uncertain. A more rational response is to embrace uncertainty by aligning sound enduring principles of economic progress and wealth creation.

Last year has shown that despite the substantial decline of global markets and global slowdown in demand and growth; India has stood its ground. Those who get overly cued to the global news flows and short-term volatility of markets will end up missing the India story. India is a breakout nation and Investors in Indian equity market will have great times ahead provided they focus on the right game - which is investing for long.

Here are few points we want to emphasis:

- Don’t let short term drawdown interrupt long term compounding. Focus on compounding Rs 100 to Rs 500 over long term than trying to escape or capture a swing of Rs 25 in near term. This is especially important in India where structural factors of growth look solid.

- Those who get overly cued to the global news flows and short-term volatility of markets will end up missing the India story. India stands well poised for a healthy economic expansion. This is not to say there are no global risks affecting India, but this is to realise that trajectory will be up despite those risks. The global economy which used to grow say at 3.5-4% may now slow down to 2-3% kind of growth rate due to a host of factors – mainly the demographics & high debt in the developed world. Global factors could bring India growth to the range of 6-6.5% even though it has potential of growing at much faster 7-8% growth rates. This change however would not take away from us the very healthy trajectory that we are in.

- Investing in a basket of stocks is the best antidote to inflation in the long run. Global inflation is likely to remain elevated. India has done relatively well helped by our food self-sufficiency. India is on steep curve of adopting several new technologies – from UPI, ONDC to renewable power. All these helps to increase productivity and tame inflation. And history teaches us that smart managements and corporates eventually absorb such inflationary trends and help their shareholders increase/maintain purchasing power.

- India remains a stock-pickers' paradise. Headline valuations in Indian market may be high but there are several pockets of value. For bottom-up stock-pickers it remains a very good market to commit capital. Broadly, the downside is limited from the fact that Indian corporate sector has gone through a decade of clean up and consolidation of balance sheet and the corporate profits are likely to grow at a healthy pace.

As we enter calendar year 2023, we are more than convinced about the businesses we own for all of you. We continue to find value in most of them, even more in some and hence would not trade them for something else that easily. As believers in the craft of stock picking and in the power of equities over long term; we confidently look forward to a bright future for all our investors.\

Happy New Year, Happy Investing.

Porinju Veliyath